ResourceS

FREE LEGAL RESOURCESBEFORE YOU VISIT

Before you visit and let us help you in achieving your legal goals, take the time to browse the free legal resources we offer to get a head start. By making use of these resources, you can answer any initial questions we may have for you and get the ball rolling toward the resolution you’re hoping for. To get started, just ask yourself one quick question: Why are you here? Then, find the corresponding intake form and start filling in the information. It’s that simple!

Intake Form Foreclosure

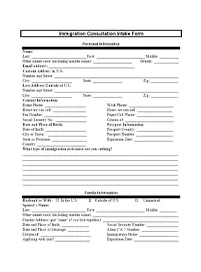

Intake Form Immigration

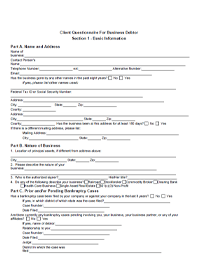

Intake Form Business

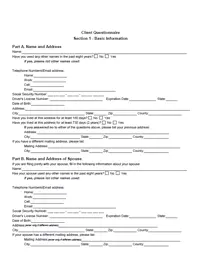

Intake Form Individual & Joint

FREQUENTLY ASKED QUESTION

How important is the accuracy of the information provided in your initial paperwork?

To ensure the best possible outcome in your case, your correspondence with us must be honest and accurate throughout the process. From the time you begin filling out your intake form until the final decisions are made in your case, accurate, up-to-date information is crucial for us to help you get the results you’re hoping for.

For more of the answers you need, check out these frequently asked questions:

Personal Bankruptcy

How can I know which bankruptcy chapter is right for me?

There are several types of personal bankruptcy. Which chapter you file will depend on your current assets, debts, income, and financial history as well as your desired outcome after the bankruptcy. If you have significant debt you are looking to eliminate, Chapter 7 may be the right option for you!

Do I need an attorney to file for bankruptcy?

While it is not legally required that you work with a Chapter 7 bankruptcy attorney in Jacksonville, Orlando, or elsewhere, it is certainly advisable. Having a knowledgeable attorney to guide you through the Chapter 7 process and procedures will help your bankruptcy experience be smoother, faster, and yield better results. It pays to partner with a pro!

Do I have to forfeit my property in Chapter 7 bankruptcy?

Not necessarily! During a Chapter 7 bankruptcy, you may need to surrender major assets to offset the costs of your debts that are being discharged. However, many states – including Florida – have a generous homestead exemption that may allow you to keep your residential property, as well as state-specific exemptions, which, when applied correctly, can help you protect and save many of your assets.

What is the difference between Chapter 13 and Chapter 7?

Where Chapter 7 bankruptcy focuses on debt relief by way of discharge, Chapter 13 bankruptcy primarily focuses on relieving debt by helping those who are struggling with a more manageable repayment option, most often paying only a small portion of their debt. One of the big reasons many people choose Chapter 13 is because of the increased control it grants debtors while removing the burden of creditor calls and lawsuits.

Why should I opt for Chapter 13 bankruptcy?

If you have regular income that will allow you to manage repayment of all or some of your debts if they are sensibly restructured, you are a good candidate for Chapter 13 bankruptcy. It helps you take better control of repaying those debts. It is also more flexible and may allow for negotiation in payment.

What are the rules for Chapter 13 bankruptcy?

In general, a Chapter 13 bankruptcy is geared toward restructuring and manageable repayment of all or some of your debt. It also takes place over a more extended period of time, and eligibility depends on your income. See a Chapter 13 bankruptcy attorney for more information.

Can an individual file for chapter 11 bankruptcy?

Yes. While it’s true that chapter 11 bankruptcy is typically applied to businesses, it can also be applicable to individuals who have a higher income or larger amount of assets than those who meet the eligibility criteria for chapter 7 bankruptcy. Ask your attorney if you qualify.

Why choose chapter 11 over chapter 7 bankruptcy?

As we mentioned, a chapter 11 bankruptcy might be your best choice if your income or assets exclude you from eligibility from chapter 7 bankruptcy. To find out if that’s true, you’ll need to apply the “means” test to your situation. A chapter 11 bankruptcy attorney can guide you.

Is chapter 11 my only option if I am a business owner?

No. A chapter 11 is often a good choice for dealing with debt as a business owner, but you have other options as well. There are subchapters dedicated to businesses of different types and sizes, as well as business bankruptcies under chapter 7, 13, etc. Ask your attorney for details.

Dept Settlement

Do you need an attorney to find debt relief in Florida?

There are plenty of ways to approach debt resolution and relief. However, many companies exist solely to take advantage of consumers in these situations. For the best possible result, consult a knowledgeable bankruptcy attorney about your next steps.

Why do some lawyers warn against debt relief companies?

It is important to remember that debt relief companies are private, for-profit entities. While they may have friendly, courteous staff, their main goal is to profit from your situation. No matter the outcome, they will receive payment – even if you don’t get help.

What are the benefits of choosing a lawyer?

Unlike private debt relief companies, attorneys are held accountable for their actions. They won’t scam you or leave you in worse shape than you were in when you sought their assistance. If you need real help, consult a real attorney.

Foreclosure Defense

Have there been any major changes to foreclosure laws?

It is true that foreclosure laws and procedures changed significantly in 2013. These changes made the process faster and more definitive. While small adjustments are always being made to laws in this area, a practicing attorney can help you stay up to date.

Aren’t foreclosures on hold because of the pandemic?

The pandemic and subsequent economic fallout of 2020 brought many challenges, including dealing with families that fell on hard times beyond their own control. While there was a temporary federal hold on foreclosures and evictions, this has since expired.

Will foreclosure be stopped by bankruptcy?

Bankruptcy can be a great solution to dealing with a potential foreclosure, but it is not a decision to make lightly. It also isn’t right for every scenario. Always seek the guidance of legal counsel before filing for bankruptcy – even when facing foreclosure.

Business Bankruptcy

When is Chapter 7 the right choice for my business?

For a small business bankruptcy, Chapter 7 is an excellent option for relieving overwhelming debt. It is a drastic step but an effective one for struggling businesses. If you are out of options for resolving these debts, speak to a Chapter 7 bankruptcy attorney about finding the relief you need.

Is a Chapter 7 bankruptcy my ’business’s only option?

Not at all. As a business owner, you have several options for dealing with debt. Chapter 7 bankruptcy might be your best option, but filing a bankruptcy under Chapter 11 may provide you with different or more preferred results. Chapter 11 allows for the restructuring of debt. Talk to your attorney to find out more about which is your best choice.

When is a small business bankruptcy the right choice?

Getting behind on payments can be extremely detrimental to a business. This is especially true of small businesses, who may not have the capital to catch up once they get behind. Bankruptcy can keep your doors open while you restructure and relieve your debt in a manageable way.

Why choose a small business bankruptcy Chapter 11?

A Chapter 11 bankruptcy is often a great choice for small businesses. There are even specific subchapters dedicated to smaller companies that are struggling with debt. If your company is small or even single-person, speak to a lawyer about the advantages of a Chapter 11 bankruptcy for managing your debt and obtaining the relief needed to get back on your feet.

Do I really need the help of a bankruptcy attorney?

While it is technically perfectly legal to pursue a bankruptcy without the assistance of a lawyer, it is not advisable. Attorneys understand every aspect of the bankruptcy process. Do not go it alone when you do not have to. Speak to a professional to get professional results!

Immigration

Why is consultation with an immigration lawyer advisable?

A knowledgeable legal professional can help make the navigation of the process of legal immigration simpler, faster, and make it work for you. Whether you’re seeking a temporary extension or a permanent solution, working with an attorney is the best way to find it.

Do I have to speak to an immigration attorney in Orlando?

Yes, many aspects of the United States immigration laws did change during the last presidential administration. While we may soon see change to these laws again, your best bet is to work with a knowledgeable attorney both now and moving forward to navigate them.

What if my immigration status is in question?

Don’t let fear or confusion stop you from reaching out. By speaking to an immigration attorney in Orlando or Jacksonville, you can get yourself or your loved one on the path to legal citizenship, a visa, green card status, or anything else you’re looking for!

Immigrant Visa

Do you need a lawyer to apply for an immigrant visa?

While it isn’t legally mandated that you consult with an attorney throughout the visa application process, it is highly advisable. Given the often-confusing nature of the procedure, those who partner with an immigrant visa attorney stand the best chance of acceptance.

Haven’t the immigration laws changed?

While consultation with an immigration lawyer is not legally required when navigating the immigration process, it is certainly advisable. This is especially true if you’re dealing with language barriers. Let a professional guide your steps to citizenship!

What if I change my mind later about visas, citizenship, etc.?

Since your attorney will understand all of these aspects of United States immigration law, it is important to keep them abreast of all changes you may make to your plans. This way, they can help you achieve your goals, even if they change!

Non-Immigrant Visa

Does your visa grant your automatic entry into the US?

No. While your visa will get you as far as a port of entry to the United States, the border patrol or customs team in charge of that port will determine the legality of your visit and how long you may stay.

Do you have to live in the United States to work or go to school here?

Not necessarily. There are various types of visas and other programs that allow for students and professionals to enjoy temporary residence in the United States without the intention of permanent relocation.

How do I know which type of visa I need for my stay?

This can be tricky, since various types may apply to your scenario. To find the best fit, be sure to speak to an attorney for guidance.

Green Card

Do I need an attorney to get a green card?

The short answer is no. However, while an attorney is not a legal requirement for getting a green card in the United States, it is highly advisable. Your lawyer can help you navigate parts of the process you don’t understand and improve your chances of success.

How has immigration law changed recently?

During the Trump presidency, the United States tightened restrictions involving which applicants for green cards could receive them. While these regulations are being gradually loosened, some may remain, making obtaining a green card more difficult.

What can a lawyer do to help you achieve your goals?

By helping you better understand the current laws and how they apply to your situation, your attorney can help you make the case for your approval – and secure the green card or visa you’re hoping for.

USEFUL LINKS

Looking for more? At the Szabo Law Group, we have the free legal resources you need to get started with your journey toward meeting your immigration goals, fixing your finances, or whatever else you might be looking for. In addition to the information that you can find here, we also offer plenty of legal knowledge and real-world experience to help guide your decisions and help you make the best ones possible. Still not sure what you need? Give us a call today and we can help there, too!